Best Practices in Demonstrating Value and Creating Fair Compensation for Channel Partners

Overview and Need

Distributors and their manufacturer partners are being asked to bring new value to the supply chain. Customers require new services and innovative products to move to the next level of competitiveness. For manufacturers, these innovative products are experiencing a shorter lifecycle. To be efficient, they must create new offerings and get them up the growth curve faster than the competition so that economies of scale can be captured before the product drops to commodity status.

For the distributor, the challenge is more complex. They must assist the supplier in new product development through more advanced and targeted market intelligence and spearhead an advanced rapid deployment to get the product to market. This requires an ever stronger sales and marketing capability directed at supporting the supplier. Distributors have traditionally spread their sales efforts across many, often competing manufacturers to hold down costs. A focused effort requires new skills and more resources.

Customers, meanwhile, are showing less interest in this process and even pushing back on the distributor’s outside sales efforts. To combat this disturbing trend, distributors are seeking closer customer relationships where the distributor’s customer contact personnel are viewed as adding value to the customer (consultative selling). The customer, however, continues to put pressure on the distributor’s margins demonstrating a poor appreciation of the value these new services are providing. The result has been an increased need for distributors to seek compensation from suppliers and find new ways to be compensated directly by customers (fee for service). The transition is causing channel disruptions.

Manufacturers who sell through distributors have a great deal at stake. If the distributor is unable to make the transition and remain profitable, manufacturers may see the channels consolidate to a few “big boxes” with narrow margins, little to no sales effort on the manufacturer’s behalf, and a tremendous purchasing power wielded against the manufacturer. The only defense, once the distribution channel consolidates, would be manufacturer-owned distribution. Besides the many well-documented issues and failures associated with captive distribution, the manufacturer will be taken out of their core competency. This inability to focus on new product design, introduction, and efficient manufacturing will put many firms at risk.

Simply put, the existing model of “every man for himself” when it comes to channel compensation must change. This consortium will investigate how distributors and their suppliers collaborate to create value, to explain that value to channel partners, develop compensation methods beyond simple gross profit on products, and remain competitive while maintaining equity in the supply chain. The consortium will explore the following issues:

- Determining how service models are changing and how distributors are being compensated for new processes.

- Capturing best practices in manufacturer-distributor collaborations in taking new products to market and speeding new product introductions.

- Examining and documenting distributor compensation models in terms of traditional product margin (distributor-driven), fee for service (customer-driven), incentive based (manufacturer-driven), and hybrid models.

- Determining the role, value and cost of new sales and marketing models.

- Documenting best practices in distributor compensation models. The current distribution model is not being threatened with extinction but rather with rapid change. Manufacturer partners who understand and support positive change will not only help their distributors to succeed but also protect their own profitability. Understanding the new environments, rather than reactively responding to change is more critical now than in the past.

Consortium Deliverables

Consortium members will participate directly in the research and gain a better understanding of the findings. The full report will be issued to each consortium member with all analysis performed on the firm itself with the firm’s data. Direct recommendations will be made for each individual participant firm on:

- Creating and developing value propositions for new products and services.

- Delivery methods (sales and marketing) for these constantly evolving value propositions.

- Optimal compensation schemes that achieve equitable compensation between supply chain partners.

- Analysis methods for demonstrating value.

- All tools created to complete the study and analysis for the study.

All consortium member results and data shared with researchers will be kept confidential. Only general findings and best practices will be shared with other consortium members. Distributors will benefit from the research findings and from sharing best practices with other cutting edge firms in the consortium. Manufacturers will benefit from shared and strategy development study with the distribution community.

Why Compensation Must Be Addressed

A great deal of pressure is being brought to bear on channel members. Continuous pricing pressure has driven many distributors to seek volume over specialization. Many customers go around the distributor to directly negotiate with the supplier putting the entire burden for compensating the distributor on the supplier. This volume driven mentality leads to a lack of focus on new product introductions or service innovation. The process leads to customers calling the shots on services and deciding what and how the distributor should be paid.

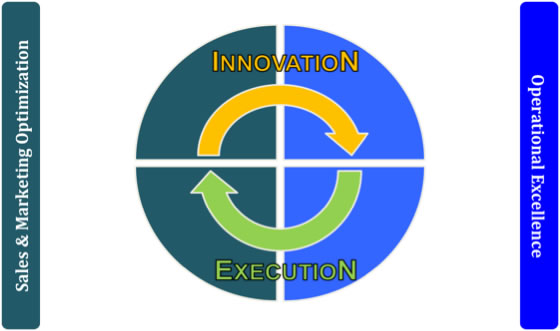

Figure 1: The Innovation and Execution Cycle. Copyright 2019 Read Center.

The innovation process needs careful management throughout the product or service lifecycle (see Figure 1). The process begins in the upper left corner with the sales force introducing new offerings to the customer. In the upper right corner the distributor and manufacturer’s operations collaborate to create and deliver the offering while the sales and marketing team works on the value proposition. In the lower right, operations optimizes the offering, and sales perfects the value proposition. The final, very important, phase is the lower left where the sales and marketing team continues to support the optimized offering and captures superior earnings for the distributor and the supplier.

The process has many opportunities for collaboration and differing compensation levels at each phase. If the distributor is not compensated and partnering with the supplier correctly, the distributor will be forced to support those parts of the cycle (lower right and left) where they can do the most volume. The supplier will have to make the first two sectors successful. The process will lead to a weak customer relationship for the distributor and a high cost of new product introductions for the supplier (sales efforts and product failures).

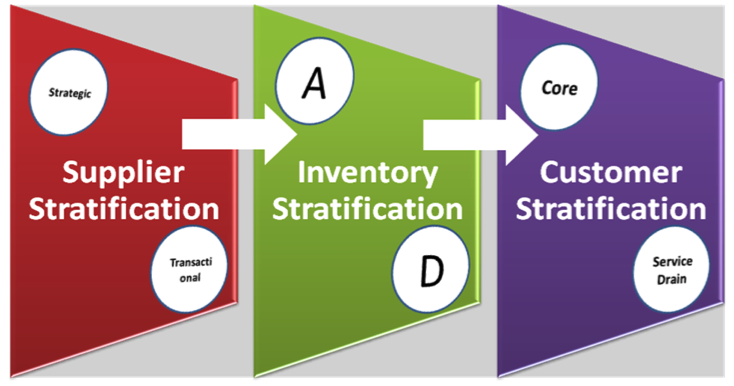

Thus optimizing channel compensation has a direct impact in aligning three key resources (supplier—distributor—customer) of a supply chain (see Figure 2), which leads to successful and sustainable collaboration in the long term.

Figure 2. Supplier-Distributor-Customer Alignment. Copyright 2019 Read Center.

Solution Approach

Best Practices will be established and tested for:

- Compensating Distributors for new product and service offerings.

- Collaboration between manufacturers and distributors, protecting profitability for each.

- Development of value propositions under rapidly changing service and product offerings.

- Documentation of best practices in compensation equity in the supply chain.

Methodology

Even though many distributors may be somewhat familiar with these concepts and may utilize them to some extent, understanding and implementing a holistic approach to date has been achieved by only a select few. The development of tools that will enhance the scientific decision making capabilities and implementation procedures of firms will be the primary focus of the consortium.

The key project steps are:

- The Texas A&M research team will conduct a survey of current channel compensation strategies across wholesale vertical marketing channels and conduct ad hoc research to determine best practices.

- The first consortium meeting will bring together member firms to report initial results, share best practices, and engage member firms in the research findings and define final deliverables with counsel from the consortium members.

- Through a series of research workshops with member firms and ad hoc research the research team will:

- Conduct quantitative and qualitative research to identify the most common compensation practices.

- Conduct quantitative and qualitative research to identify and develop best practices.

- Quantify the impact of these strategies and develop methods to incorporate them into compensation models that can be driven through robust analysis programs based on data and information routinely absorbed by the firm.

- Develop a scientific model to determine the optimum of manufacturer-distributor compensation schemes that drive growth for both.

- Develop value proposition tools and processes to capture optimal compensation throughout the innovation – execution process.

- The final consortium meeting will share results and capture final feedback and thoughts from member firms.

- Member firms will receive a final report detailing tools and methodologies based on data and scenarios shared and created in the workshop sessions. These findings are confidential to the member firm.

- Texas A&M University will present two consortium member only education sessions on Optimizing Channel Compensation to which consortium members will receive ten free seats.

Value to Members

The consortium members will receive results, methodology and tools developed during this pioneering research in Optimizing Channel Compensation. The key advantage for Distributors and Manufacturers would be to gain competitive advantage by implementing the scientific Optimizing Channel Compensation methods or using the tools developed to maximize value propositions. The key advantage to Technology companies will be to gain the knowledge base, methods and tools that can be implemented in their systems. Apart from shaping research focus and gaining a valuable knowledge base, methodology and tools, each consortium member will be able to send up to a total of 10 people to 2 educational sessions that will be developed from this research. The educational sessions alone represent a $20,000 value.

Schedule

| May – December, 2011 | Membership Enrollment and Consortium Formation |

| January – February, 2012 | Consortium Kickoff Meeting |

| March – October, 2012 | Conduct Research Workshops |

| November 2012 – March 2013 | Research and Develop Tools |

| April 2013 | Final Consortium Meeting |

| May – July, 2013 | Develop Educational Program |

| October 2013 | Deliver Educational Programs |

For more information about the Optimizing Channel Compensation Research Consortium, contact:

Ron Schreibman

Executive Director

NAW Institute for Distribution Excellence

1325 G Street, NW, Suite 1000

Washington, DC 20005

Office: (202) 872-0885

Fax: (202) 785-0586

E-mail: [email protected]

Website: http://www.naw.org

F. Barry Lawrence, Ph.D.

F. Barry Lawrence, Ph.D.

Leonard and Valerie Bruce Leadership Chair,

Professor in Industrial Distribution,

Program Coordinator, Industrial Distribution Program,

Director, Thomas & Joan Read Center for

Distribution Research and Education,

Director, Global Supply Chain Laboratory.

3367 TAMU, Texas A&M University

College Station, TX 77843-3367

Office: (979) 845-4984

Mobile: (979) 574-4178

Fax: (979) 845-4980

E-mail: [email protected]