Analytics Advantage for Profitable Decision Making

Copyright Read Center 2019.

Overview and Need

Complexity is not a new concept for wholesaler-distributors. Distributors thrive on challenges create competitive advantage based on the fact that other firms cannot adapt as quickly to complicated market shifts. This complexity may be introduced from customers through the need for technical skills, product availability, product breadth and depth, working capital flexibility, special packaging requirements, service level needs, and other customer service aspects. On the supplier side, complexity can lead to product and supplier proliferation, challenges with channel compensation (rebates and chargebacks), new product introductions, technical support systems, channel power and control, alternative distribution channels, supplier go to market strategies, etc. Apart from suppliers and customers, distributors face challenges from economic conditions, regulation, changing levels of channel capacity, competitor strategies, technological and social change, etc. Predictability and stability are being replaced by continued volatility and uncertainty.

Progressive distributors constantly refine and enhance their ability to adapt to these new scenarios – whether it’s identifying profit leakage in channel compensation, determining the right price for a given customer, managing working capital through effective inventory and account receivable management, or motivating the workforce. The common thread among these activities is the application of analytics. Analytics is the hidden force that brings sanity to profitable decision-making. Top-quartile distributors use data analytics identify patterns in customer buying behavior, analyze customer-level profitability, assess operational efficiency opportunities, manage cash flow through inventory levels, target micro market segments, detect salesforce performance gaps and many other applications. The successful distributors used analytics as a tactical weapon, not strategically. Even the top performers have only begun to unlock the power contained within the distributor’s data. Leading distributors are coming to realize the data they own is a gold mine which will determine their future success. Others have ignored the explicit use of analytics by relying on information technology applications generated by IT firms and consultants. Others relate data analytics to their not-so-great experience in implementing ERP or other IT applications and stayed away. Still another group of distributors were less enthusiastic due to a limited use of existing analytics resources such as reports and dashboards. Some distributors have refused to enter the analytics arena out of the fear of opening a Pandora’s box of data (both availability and integrity).

Recent developments in cloud computing and distributed processing have brought down data storage and computing costs drastically. Breakthroughs in commercializing tablet and smart phone technologies have introduced a new stream of enthusiasm among data or information consumers. The same old report is accessed with renewed interest due to improved user interaction. Business users have entered a new world of accessibility. Internet applications (ranging from social media sites to business e-commerce platform) have helped both consumers and businesses create and capture more data than ever at an exponential rate. As these forces – affordability, accessibility and availability – converge, they are creating a huge network of unprecedented, innovative opportunities to create and capture value in the channel through analytics.

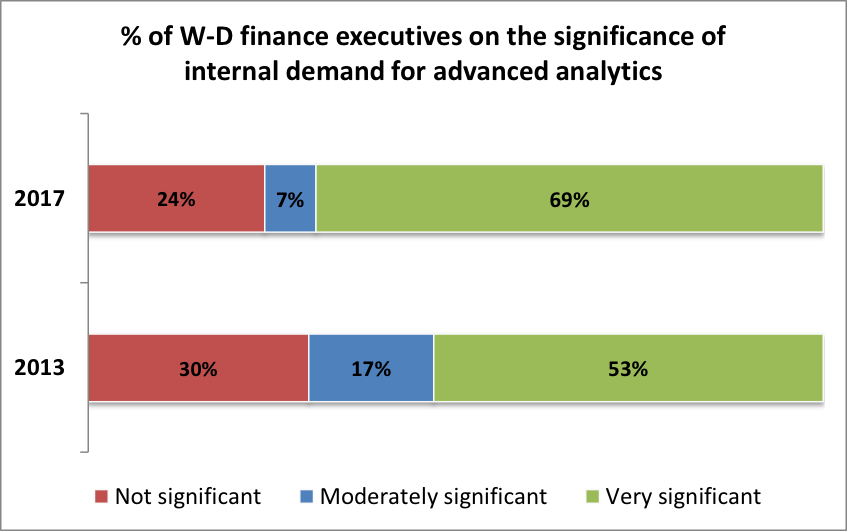

Wholesaler-distributors, now, have a strategic tool – business analytics – that can help them be nimbler than ever in adapting to an evolving complex business landscape. This provides a great platform for distributors to be innovative, hence differentiate their business model. This is echoed by wholesaler-distributors in their response to the significance of demand for analytics, in a recent ‘Facing the Forces of Change’ industry study.

Copyright Read Center 2019.

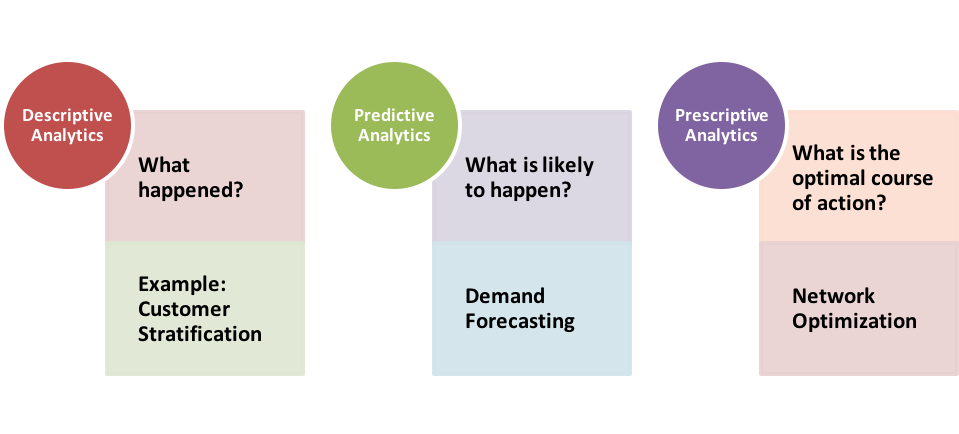

There are different types of analytics – ranging from descriptive to predictive to prescriptive – as shown in the exhibit below. The descriptive analytics focuses on reporting what happened through dashboards and custom reports. This includes analyses such as inventory and customer stratifications. The predictive analytics employs special algorithms to predict or project what will likely happen based on past occurrences. The demand forecasting for the upcoming months is a good example of predictive analytics. Finally, prescriptive analytics uses advanced mathematical methods such as optimization to help firms understand and decide future course of actions for various future scenarios based on critical trade-offs such as service vs. cost. A common example would be performing network optimization of distribution locations and determining optimal footprint for projected growth scenarios.

Copyright Read Center 2019.

Current needs and trends in wholesale-distribution are pointing towards analytics. It will no longer be optional for a firm to invest in analytics. Analytics will determine the sustainability of all companies. The “lean principles” movement started with manufacturers and moved into distribution to drive operational excellence. The analytics movement maturity in the retail industry is higher than it was about 5 years ago. Distributors should not wait and play catch up but instead need to start focusing their energy on business analytics. Best in class distributors have already positioned themselves better by developing analytics capabilities – tools and training in the area of inventory management, pricing and sales management.

A building material distributor said, “A few years ago it was not possible to convince my employees to get their hands on our business analytics tools and our in-house data management system. Now my sales team is providing as much market intelligence as possible to help us help them with meaningful information using analytics and they are requesting for applications that can be accessed via their smart phones.” Technology capabilities and employee buy-in have never been so receptive for business analytics. There is no better time than now to research and implement business analytics.

Research Objectives

This new landscape of opportunities introduces new questions:

- As a wholesaler-distributor, where would I start in order to capture and leverage data analysis?

- If my firm has already started the journey of analytics, how do I assess my capabilities? Where are my next opportunities?

- If my firm is facing challenges in implementing analytics, how do I manage the turmoil and migrate to profitability?

- Many such questions exist in the industry.

This leads to few key objectives that need to be explored and answered while understanding and leveraging analytics for wholesaler-distributors.

- Assess analytics capabilities of wholesaler-distributors.

- Determine analytics applications and related business opportunities in wholesale-distribution.

- Understand key challenges in implementing business analytics and best practices to overcome those challenges.

- Quantify the ROI implications for strategic investments in analytical capabilities.

- Finally, develop a roadmap for optimizing shareholder value through analysis.

These objectives represent the industry challenges broadly but the consortium members will have a chance to shape these objectives to suit their strategic goals. The consortium set-up (cross-industry collaboration and individual workshops) is designed for the very purpose of understanding industry-wide challenges and firm-specific opportunities. In other words, these objectives are a starting point and will provide a good platform for consortium members to discuss, understand and explore specific challenges.

Consortium Deliverables

- A platform for interacting with similar-minded, pioneer firms (kick-off and final meetings).

- A company-specific research workshop.

- The consortium members will receive results, methodology and tools developed during this pioneering research in Optimizing Business Analytics.

- Assessment of analytics capability.

- Analytics opportunities for optimizing shareholder value.

- A framework of tools, processes, methodologies and metrics.

- Best practices for applying analytics.

- Roadmap for successful implementation.

- 5 complimentary seats for educational sessions.

- All consortium member results and data shared with researchers will be kept confidential. Only general findings and best practices will be shared with other consortium members.

Why Join a Research Consortium?

Many times companies cannot afford to invest in some research and development projects due to the high cost and/or a lack of the knowledge resources required to conduct the research. Research Consortia are an economical path to low cost, high quality research and development that is essential to the growth of the company. Consortia also allow for the sharing of best practices and strategies between the cutting edge organizations that invest in such efforts.

Who Should Join this Research Consortium?

This Research Consortium will be beneficial to Wholesaler-Distributors and Manufacturers who go to market through Distributors.

Value to Members

- Consortium members will participate directly in the research and gain a better understanding of the findings.

- The key benefit for wholesaler-distributors would be to gain competitive advantage by implementing innovative best practices ahead of their competition.

- Develop relationship by networking with pioneer firms

- Apart from shaping research focus and gaining a valuable knowledge base, methodology and tools, each consortium member will be able to send up to a total of 5 people to an educational sessions that will be developed from this research. The educational sessions alone represent a $10,000 value.

Schedule

| Membership Enrollment & Consortium Formation | July 2015 – Jan 2016 |

| Consortium Kickoff Meeting | Feb 2016 |

| Conduct Research Workshops | Mar – Oct 2016 |

| Research and Develop Tools | Nov 2016 – Feb 2017 |

| Final Consortium Meeting | Mar – April 2017 |

| Develop Educational Program | May – June 2017 |

| Deliver Educational Programs | July 2017 onwards |

Consortium Structure and Fees

The membership fee is $25,000 per company in the consortium. The fee will cover attendance in consortium meetings hosted by the Global Supply Chain Laboratory at Texas A&M University and workshops with member firms to design the research solutions personalized to their needs.